japan corporate tax rate 2017

Measures the amount of taxes that Japanese businesses must pay as a share of corporate profits. 96 67 96 70 Local corporate special tax or special corporate business tax the rate is multiplied by the income base of size-based enterprise tax.

Australia Tax Income Taxes In Australia Tax Foundation

Total Thousand toe 1998-2017 Japan red Total Thousand toe 2017.

. Over JPY 8 million. Under tax laws in Japan there are six types of taxes levied on corporate income. Effective Corporate Tax Rates With Alternative Rates of Inflation.

Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. The government initially planned to reduce the rate to below 30 percent in fiscal 2017 after. The government initially planned to reduce the rate to below 30 percent in fiscal 2017 after cutting it to 3133 percent in.

However a branch and a Japanese company have differing legal. And 31 March 2017 Tax rates for companies with stated capital of JPY 100 million or. Historical Corporate Tax Rates and Brackets 1909 to 2020 Historical Federal Corporate Income Tax Rates and Brackets 1909 to 2020.

Income from 0 to 1950000. Year Taxable Income Brackets Rates. 115-97 replaced the graduated corporate tax structure with a flat 21 corporate tax rate and repealed the corporate alternative minimum tax AMT.

SME Agency FY 2017 Tax Reform leaflet J MOF J EY PWC 3 Corporate Governance Reform and arrangements for reorganizations 1 Extension of Filing due date of. Effective Corporate Tax Rates With Alternative Allocations of Asset Shares in G20 Countries 2012 34 Figure B-2. Dec 2014 Japan Corporate tax rate.

Japan Tax Profile Produced in conjunction with the KPMG Asia Pacific Tax Centre Updated. Japan Income Tax Tables in 2017. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an.

2017 tax reform proposals in Japan. Donations and the corporate income tax rates are the same for both a branch and a Japanese company. 2017 tax reform proposals in Japan.

Corporate Tax Rates 2022. Corporate tax in Japan. At present Japans corporate tax rate is 3211 percent.

Dec 2014 Japan Corporate tax rate. At present Japans corporate tax rate is 3211 percent. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

Proposals that aim to promote. On 8 December 2016 Japans Liberal Democratic Party and the Komeito Party released tax reform proposals for 2017. Tax rates for fiscal year filers.

The corporate tax rate in Japan for a branch is the same as for a subsidiary. The United Arab Emirates has the worlds highest corporate tax rate and several Caribbean nations. Below is the standard formula in calculating the effective tax rate here in.

Canada Tax Income Taxes In Canada Tax Foundation

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

3 7 Overview Of Individual Tax System Section 3 Taxes In Japan Setting Up Business Investing In Japan Japan External Trade Organization Jetro

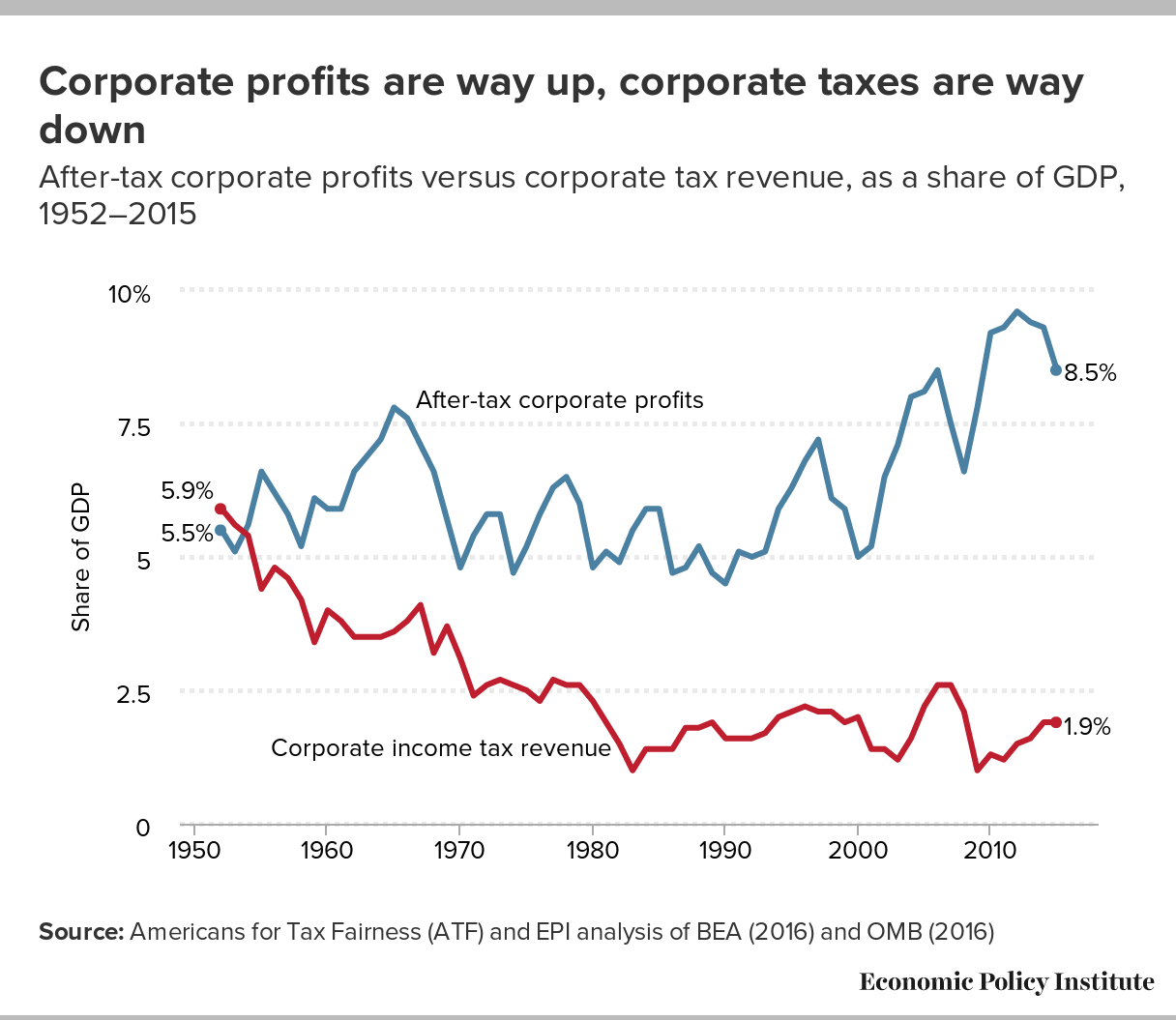

Competitive Distractions Cutting Corporate Tax Rates Will Not Create Jobs Or Boost Incomes For The Vast Majority Of American Families Economic Policy Institute

Japan National Debt 2027 Statista

G7 Backs Global Corporate Tax In First Step Towards Reform Economist Intelligence Unit

Business Capital Gains And Dividends Taxes Tax Foundation

Corporate Tax Reform In The Wake Of The Pandemic Itep

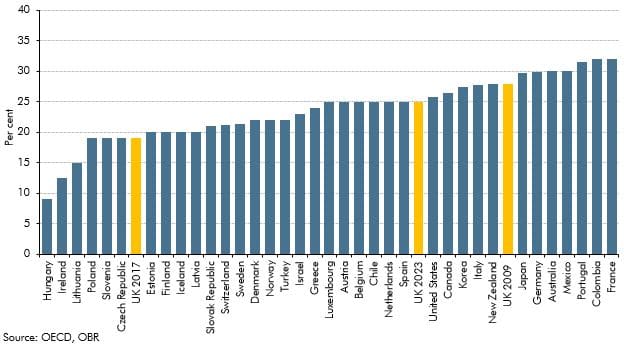

Corporation Tax In Historical And International Context Office For Budget Responsibility

Corporate Tax Reform In The Wake Of The Pandemic Itep

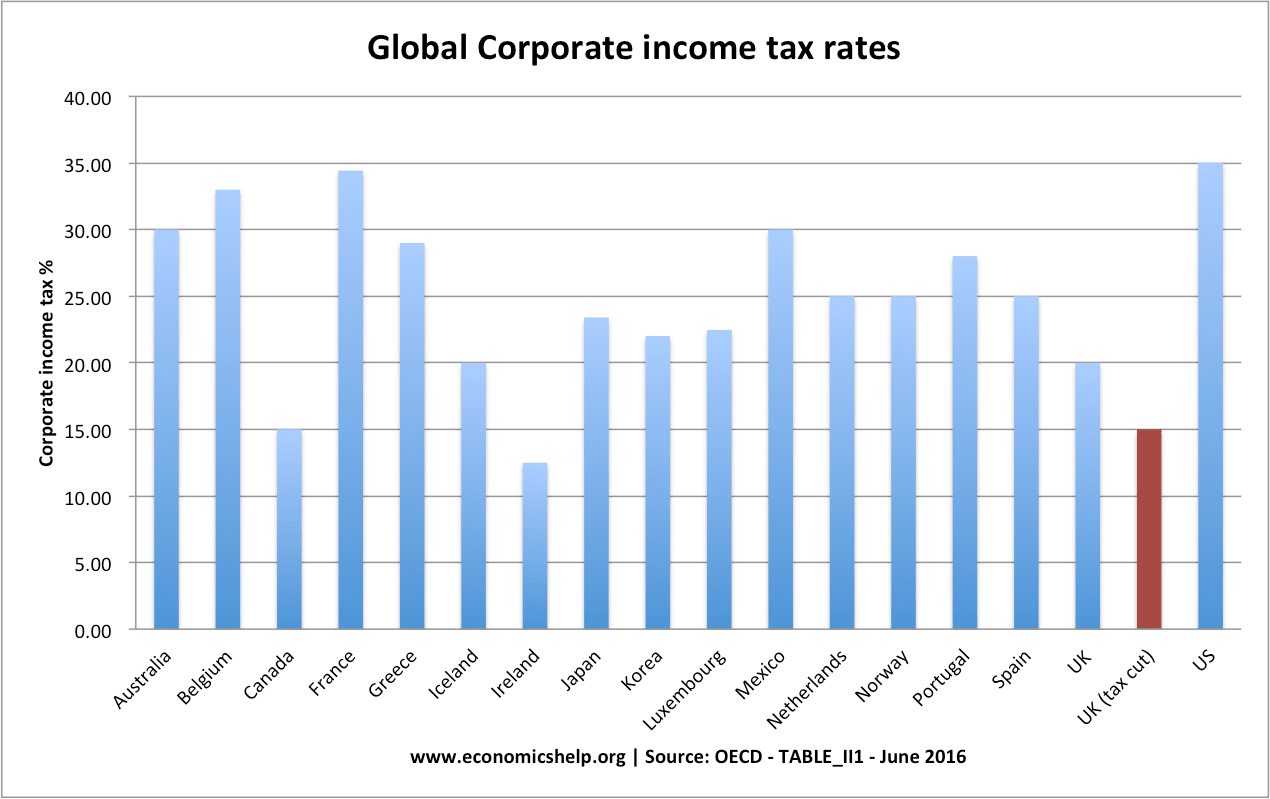

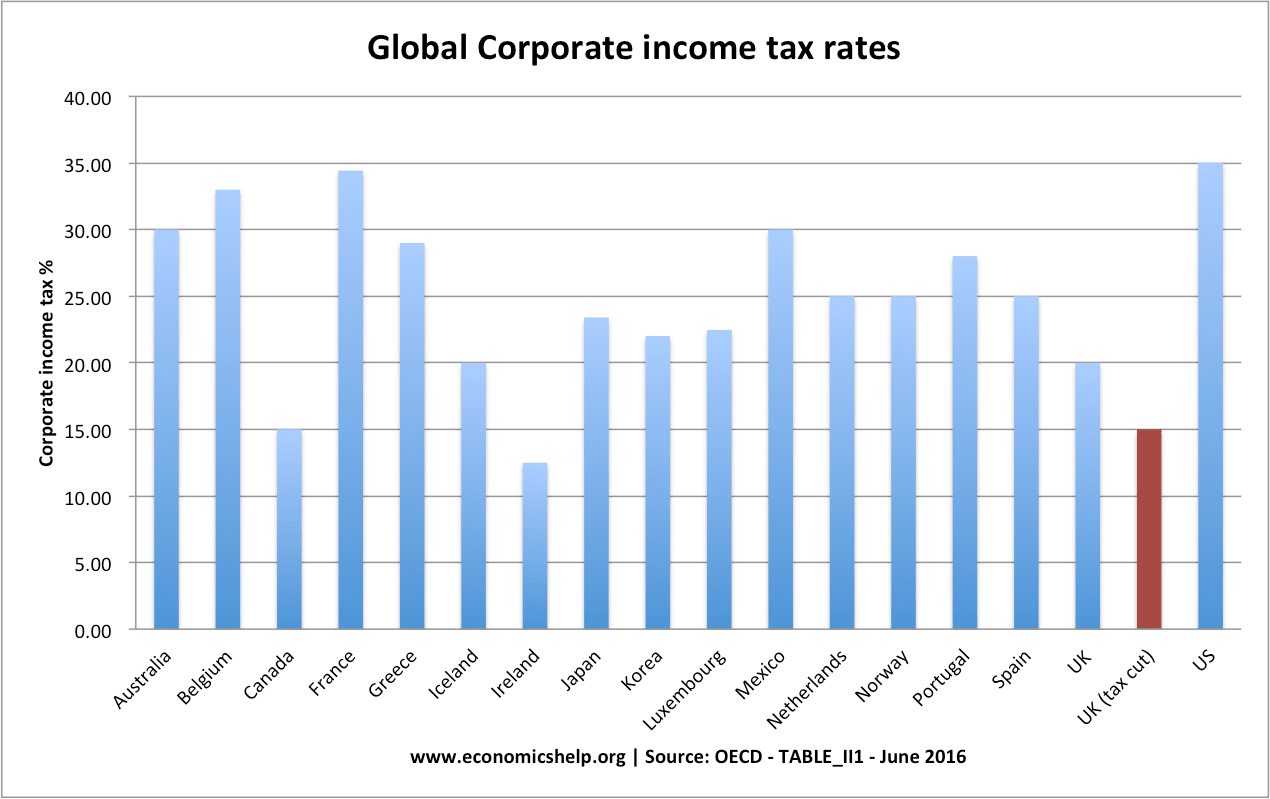

Does Cutting Corporate Tax Rates Increase Revenue Economics Help

How Do Taxes Affect Income Inequality Tax Policy Center

Corporation Tax Europe 2021 Statista

Australia Tax Income Taxes In Australia Tax Foundation

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Corporate Income Tax Cit Rates